- Published on

Where are we going?

It’s tempting to frame robotaxis as LiDAR vs. vision-only. The tech debate is fun, but it’s a sideshow. The real question is: which business model wins? This is about how costs, incentives, and distribution are organized. This is also where Uber’s role gets interesting.

I was struck when I learned

, letting riders book a Waymo directly in the Uber app. At first, it felt counterintuitive. Why wouldn’t Waymo want to own the customer relationship? Waymo has rolled out its own app experience. Aren’t autonomous vehicles supposed to be cheaper than human-driven cars? These cars are already the hottest tourist attractions in SF.For Waymo, Uber solves the hardest part: getting riders and fleets on board at scale.

Uber’s business model in two equations

To see why Uber matters to Waymo, it helps to look at Uber’s economics. At its simplest:

Leftover for the human = What the rider pays – Uber’s cut – car costs.

Car costs = Depreciation (10–15%) + Loan interest (2–5%) + Fuel(5–10%) + Insurance(3–6%) + Maintenance(2–5%)

Once you break down the car costs, it becomes clear: Uber’s business model has low

. It has built a massive network of cars without owning them. That’s why you see Uber experimenting with car marketplaces like this , letting drivers access vehicles through financing or rental partners.So now the question is who wants to provide capital for all the Waymos? As they could cost up to .

What Waymo needs to decide

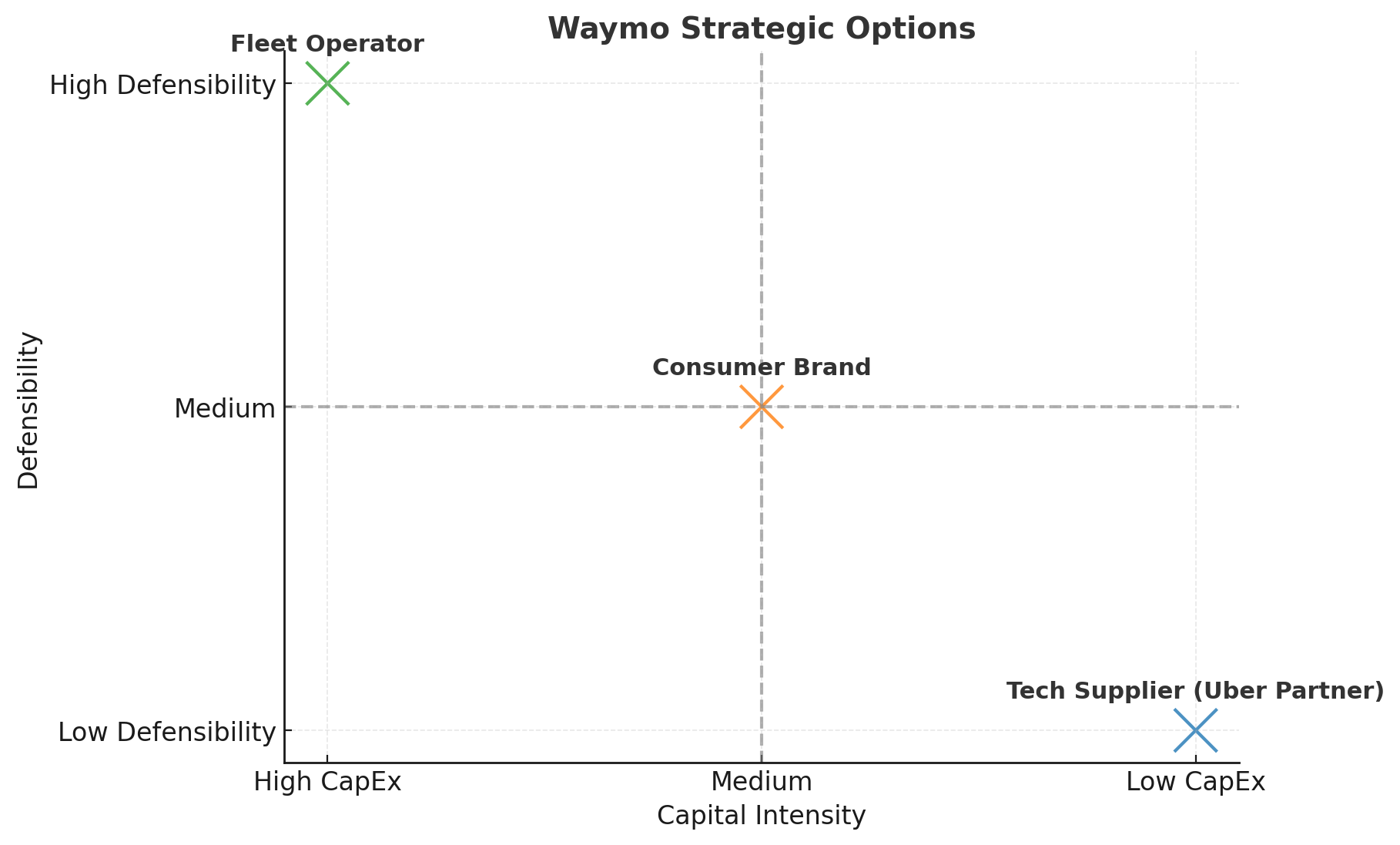

The open questions for Waymo are not small.

- Does Waymo really want to burn cash running and financing fleets? That’s a very different muscle than building the autonomy software.

- Should Waymo try to own the customer relationship, taking on Uber and different competitors in the ride-hailing market? Does the product have enough differentiation?

- Or does it make more sense to be a technology supplier, licensing the software and letting Uber or anyone else handle fleets?

How Uber helps Waymo

Seen through the lens of Uber's business model, the Waymo–Uber partnership makes a lot of sense.

- It gives Waymo instant distribution. Millions of customers already open the app. No more growth hacking.

- And a fleet marketplace built through partners like Hertz and Splend. No more worrying about financing or maintaining the fleet.

All this provided on a global scale.

Lord Elon's different bet: own everything

While Waymo leans on Uber to stay asset-light, Tesla is doing the

It is betting on owning the whole thing. Tesla builds the cars, designs the chips, runs the software, and owns the customer relationship end to end.The advantage is control. Hardware and software are tuned together. Cars can feed data on a global scale. And Tesla has a direct relationship with millions of customers.

The disadvantage is capital intensity. Even if buyers finance their cars, Tesla still carries the burden. It has to fund factories, run the supply chain, and operate service centers worldwide.

My take: market splits into Android vs Apple models

Within 5–6 years, the market starts to split: - One path looks like Android: Waymo/Baidu license their technology, Uber/Didi provides distribution, and OEMs like Toyota supply scale. - The other looks like Apple: Tesla bets on end-to-end control, from cars to software to insurance.

Final thoughts/questions

- Is Uber’s moat the strongest? Whoever owns the rider owns the market. If riders think “Uber” first, Waymo risks becoming only a technology supplier.

- Should we be long Hertz and the rental giants? Financing and maintaining fleets is messy work. Hertz already knows how to do it at scale.

- Can Tesla survive a capital-heavy game? It wants it all—cars, autonomy, insurance, software. The bet: control beats the weight of CapEx.

- Is there a real data moat in autonomy? Or does it lack the same self-reinforcing dynamic that made Google Search untouchable?

All in all, we are lucky to be watching the birth of new business models. Whole industries rarely reorganize themselves in real time.